NEWSLETTER

Monthly informative content, market stats, mortgage updates and so much more…

FEBRUARY 2021

FEBRUARY 2021

Good People -

January has flown by and February is rolling along at quite the clip - the real estate market for the inner East Bay has continued at an impressive pace. Lower interest rates keep getting better!? Lenders are offering amazing mortgage programs and those that can access these rates are pushing an under-supplied market to new heights. In 2021, I have yet to write an offer on a house that does not have at least five other offers. The listings that I have been apart of already this year are seeing similar action and very happy sellers. At the end of the day, I try and take a breath, make sure that the buys and the sells that I am apart of make sense for that person and everyone is making an informed, thoughtful decision. If you want to talk more about the market, or need some quick neighborhood stats, please feel free to reach out to me on the phone or email.

On a personal note, I hope all is well with you and your family and that the light shines a bit brighter at the end of the tunnel.

Scott

YOU'VE LIKELY HEARD ABOUT PROP 19, BUT HOW WILL IT IMPACT YOU?

Last November, California voters passed Proposition 19, impacting property owners in potentially two ways. The new law allows homeowners to transfer their property tax assessment to a new California home up to three times. This provision officially goes into effect on April 1, 2021. Prop 19 also impacts taxes on inherited properties. This portion went into effect earlier this week, on Tuesday, February 16th.

Transferring Your Property Tax Basis - Effective April 1, 2021

For some homeowners, the ability to transfer their tax basis up to three times means it's time to move. Previously homeowners could only transfer their tax base once in their lifetime and only within the same or a very limited number of counties within the state. Now homeowners aged 55 and over can move and transfer their current property tax assessment to a new primary home anywhere in California. For some, the desire to downsize, move closer to family or even finally purchase their dream home, can become a reality. The law also applies to the disabled and victims of natural disasters, like the California wildfires.

Prior to Prop 19, homeowners were also limited to the purchase of a new primary home that cost the same or less than the one they're selling. Now homeowners can purchase a property up to $1M more than their existing home in order to claim the full benefit; after $1M, the transferred tax basis will be prorated.

For example, let's say your current home has a "base year value" of $500,000 (this number can be found on your property tax bill), and it sells for $900,000. You find and purchase your dream home (in California) for $1,200,000. Your new home would have a tax base year value of $800,000.

Original property has a base year value of $500,000 and sells for $900,000

Replacement dwelling is purchased for $1,200,000

The replacement dwelling's new base year value is $800,000

$1,200,000 - $900,000 = $300,000

Property's "base year value" (from property tax bills) = $500,000

$300,000 + $500,000 = $800,000

Prop 19 allows you to transfer the tax base up to three times, however, the replacement property must be purchased within two years of the sale of the original property.

Inherited Properties Have New Restrictions - Effective February 16, 2021

With Prop 19 now in effect beneficiaries could see a substantial increase in their property taxes for inherited property on or after February 16th. Where previously there was no limit to exclusion, Prop 19's exclusions apply only to the first $1M of value.

For example, if a family home has a base year value of $300,000 and a fair market value of $1,500,000 at the time of transfer to the beneficiary, the adjusted base year value is $500,000.

Excluded under Prop 19 is the $300,000 plus $1,000,000

The replacement dwelling's new base year value is $500,000

$300,000 + $1,000,000 = $1,300,000

$1,500,000 - $1,300,000 = $200,000

$200,000 + $300,000 = $500,000

Beneficiaries must also now live in an inherited property as their primary residence in order to get the tax break. They have just one year to establish the property as their principal residence and must live in the home continuously in order to avoid reassessment. (However, if the inherited property value is more than $1M over the original tax basis, a reassessment is still likely.)

Of course this only touches upon the basics. If you have questions please reach out. You can also read more about the new laws here.

*Consult with an attorney/accountant to confirm how the new laws apply to your circumstances. Prop 19 comes with limitations and these statements are intended to be informative but not interpreted as legal guidance.

RECENT TRANSACTIONS

MARKET UPDATE: JANUARY 2021

To understand the current East Bay real estate market, we need to think back to what a "normal" January market looks like. Typically, January and February are the slowest months of the year. The homes that sell tend to be less attractive to buyers, so prices and other key metrics are also at their low points.

But not this year. The seasonality that we would normally expect in January is affecting the market far less than usual: COVID is inspiring people to move - to find more space, to leave the region - and this is spurring activity to its highest levels in years.

Even though the number of available listings was up 27% since last year, it was still not enough inventory to meet buyer demands. Homes under contract were up 51% year-over-year, and as you can see in the table above, sales were up in January by 46%. Median price spiked, growing 22%; homes sold 8.6% over asking (twice as high as last year); and sold within 24 days on market, a 39% decrease.

We expect that market activity will remain higher than last year due to the forces listed above, and differences may even increase when we start to compare to March-June 2020 when we were dealing with shelter-in-place. Owners, if you're thinking about selling, demand is particularly high so now might be a good time to take next steps. Buyers, be patient: inventory is usually low at the beginning of the year and will most likely pick up over the next few months - hang in there!

INTRODUCING ENHANCE: A BETTER WAY TO IMPROVE YOUR PROPERTY

Starting today, Red Oak Realty is announcing a unique, new home improvement program that helps sellers improve their property before they sell.

Unlike home improvement services provided by other real estate brokerages, the entire project is handled by a team of professionals, including a General Contractor, professional designers and project managers. This means the property owner does less work while getting a great result, which likely leads to a higher sales price.

The work is performed through Red Oak's exclusive relationship with The Home Co., a respected design and staging company that has been servicing the East Bay since 2007.

Enhance already has a few projects under its belt and the results are impressive, including a listing that sold 40% over asking in 6 days. Learn more about Enhance here and reach out if you would like more information.

LOCAL BUSINESS SPOTLIGHT: FARMER & THE FIG

It's well known that the pandemic has dramatically hurt our restaurant industry and it's important to help promote their business in these difficult times. For the last 25 years, the Farmer and the Fig has provided catering services and produced lunches for schools and business accounts with local and organic ingredients. Due to the pandemic, their normal means of business aren't possible so the Farmer & the Fig pivoted and now provide vacuum-sealed home meals so that you can have the freshest meal possible. With new recipes supplied on a regular basis you know you'll be getting something unique and tasty every time. Bon appetit!

733 Allston Way, Berkeley · 415.796.6425 · info@farmerandthefig.com

MORTGAGE UPDATE

For the week ending 2/12/2021, the 10-year Treasury note closed at 1.215 - easily the highest level since March 2020 - and Fannie Mae mortgage bonds followed suit by continuing the steady push higher from record lows in the last week of December. The sudden movement to higher rates has not been unusual in the COVID era as sharp increases in interest rates have been short-lived due to the continued lag in the economy and the aggressive stance of the FED as a buyer of bonds. Many traders feel that this most recent move may have some staying power but that remains to be seen. The general thinking is that when bonds are breaking barriers that haven't been challenged in nearly a year, it's not safe to bet on a return to all-time lows. The bottom line from most industry watchers is that this will continue to be a 'rising rates' environment until the markets prove otherwise.

If you have not refinanced yet, it's probably a good time to take advantage of rates with a "2" in front of them while they last. If you're considering buying a home, it's still a great time to get preapproved for a mortgage. Please contact Faramarz Moeen-Ziai at CrossCountry Mortgage via fmz@myccmortgage.com or 510.254.4697.

Personal NMLS# 342090 · Branch NMLS# 2020284 · Company NMLS# 3029

JANUARY 2021

JANUARY 2021

OH HOW FAR WE'VE COME

To summarize 2020, it could simply be said, "Phew. It's very good to have that done with." There were incredible upheavals in politics, race relations and human health, but it was also a tumultuous year in East Bay real estate (admittedly this topic pales in importance to the others, but it still bears addressing).

We've heard the stories of how the market fell off a cliff when shelter-in-place went into effect (sales were down 53% in May compared to 2019). We may have also heard that the market has steadily been recovering since then, peaking at an all-time high in sales and median price (see article below). But now the question stands: where did we end up for the year, and how is 2021 shaping up?

To best understand the seismic shift of 2020, think back to where we were in 2018 and 2019: sellers were preferring to update their homes rather than move out, and buyers were getting exhausted by the low inventory, competition and high prices. As a result, prices were plateauing and the number of sales was decreasing. At that pace, the market would have eventually started to deflate.

But then came 2020. As families worked and schooled from home, there was a big jump in "move up" sellers who needed more space. This drove sales to a 3% decline over 2019, a significant improvement over the "cliff" that we faced earlier in the year and consistent with the slow decline in sales since 2017.

As a result of buyers looking for larger properties, homes that have a yard were in greater demand than those without (with yard sold an average of 9.9% over list, without yard sold 7.9% over list), and homes with 4 bedrooms appreciated twice as fast as those with 3 bedrooms (an average of 18% for 4 bedrooms and 8% for 3 bedrooms, 2019 vs. 2020). Similarly, single-family homes were in higher demand than condos (condos sold an average of 1.7% over list, single-family properties sold 10.7% over list). We also saw a high number of sellers move out of the Bay Area entirely, with many Red Oak sellers moving to Sacramento, Oregon and Washington.

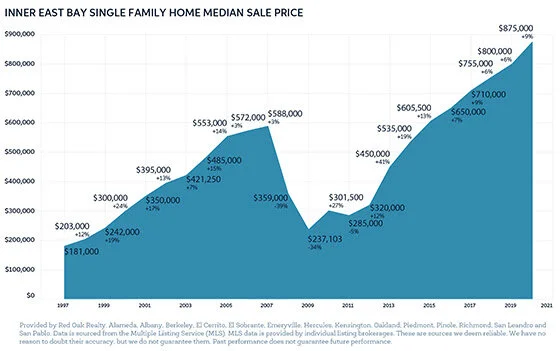

This higher level of seller activity kept inventory at record-high levels (at the end of December, there were more active listings than any time since Red Oak started tracking in 2012). Even though buyers finally had more supply to choose from, the inventory wasn't enough to meet the demand, which pushed 2020 median prices to an all-time high of $875,000, a 9% increase over the previous year.

So where does this leave us for 2021? Since September to December broke records going back 10 years and properties under contract were at their highest level in 5 years, January and February should be much more active than usual. Going forward, we suspect that inventory will remain high as people look to sell and Prop 19 spurs activity. Sales will not follow traditional seasonal patterns and hopefully, buyer demand and consumer confidence will remain aloft.

Even during the financial crisis of 2008 there was still demand for properties that had the right look, the right price, and were in the right location. In 2021, sellers should follow similar behavior, fixing up their property and pricing low to attract the widest range of buyers. Buyers should be prepared to move quickly, possibly use pre-emptive offers (which are becoming more common), and keep an open mind when looking for their home: all purchases require some compromise (yes, even for multi-million dollar properties), so you might need a little more creativity and patience to take a diamond in the rough and make it yours.

Reach out if you want to know how to best be prepared for 2021.

RECENT TRANSACTIONS

MARKET UPDATE: DECEMBER 2020

What a year. The East Bay real estate market started with a COVID full-stop in March and ended by breaking some impressive records.

With sellers moving up or out of the region and buyers absorbing the higher levels of inventory, December sales increased 45% compared to the previous year, December's highest level since 2004 and the largest year-over-year increase since 2008. Median price reached another all-time high: $1,060,000, a whopping 17% increase over the previous year. Homes sold an average of 9.3% over list price, the highest December ever recorded, in an average of just 21 days, the lowest December ever recorded.

January is shaping up to be another strong month, with inventory 38% higher than 2020 and the number of homes under contract 72% higher than last year (as of 1/4/21). We are seeing a large number of sellers getting ready to list sooner than the typical spring selling market, so buyers should be ready to move quickly, and sellers should be ready for a high level of competition.

MORTGAGE UPDATE

Rates spiked on Wednesday 1/6/2020 following the results of the Georgia run-off election. Markets were expecting a split government, resulting in very little change with Republicans in the Senate expected to revert to an obstructionist stance with the new administration. With the surprise sweep by the Democrats in Georgia, the door opened to the possibility that Democrats can advance their agenda which could mean increased stimulus payments and more aggressive government spending. More government spending means more debt, which means more bond issuance and greater supply, which means higher rates. The 10-year note jumped to over 1.00% for the first time since COVID that day and stayed there for the following few days. Rates started to recover during the week of 1/11 (as they have throughout the pandemic after previous spikes) and appear to have stabilized again near record lows. The long-term projection is pointing to higher interest rates but for now, the market held and showed another example of its resilience.

For now, rates are at record lows and it's still a great time to refinance or get preapproved for a mortgage. If you have any questions, please contact Faramarz Moeen-Ziai at CrossCountry Mortgage via fmz@myccmortgage.com or 510.254.4697.

Personal NMLS342090 | Branch NMLS2020284 | Company NMLS302

LOCAL BUSINESS SPOTLIGHT: ARTIS

Motivated to make sure everyone has the freshest coffee, Artis roasts a pound at a time so that you can enjoy your coffee at the peak of its flavor. They are passionate about exploration, engagement and enjoyment of all things coffee by offering the finest, sustainable and ethically sourced coffees from around the world. If you need help to find the perfect home brewing method - these coffee experts will help you choose just the right brewing equipment and accessories you need. Take the time to grab a delicious cup of coffee or a bag of beans to enjoy at home from this wonderful local coffee shop.

Order ahead online · 1717 4th Street, Berkeley 94710

DECEMBER 2020

DECEMBER 2020

Happy holidays!

I extend a toast to everyone's health and well-being. Take some time to get into nature, cook good food, connect with loved ones, and be reminded that there is power in the collective. This year has taught me many important things and I hope to connect with you early in 2021, renewed, refreshed, and ready for hugs!

Scott

SUPPORTING EAST BAY BUSINESSES FOR THE HOLIDAYS

The diversity of the East Bay is quite inspirational - it offers a little something for everyone. To protect the variety of local businesses that make our community unique, let's choose to buy from small businesses we know and love. Here are a few that we hope you'll want to support this year.

Foodies & Chefs

For food lovers in your life, here are a few local eateries we think they'll enjoy:.

La Farine French Bakery in Oakland

Oaktown Spice Shop in Albany, Oakland and Castro Valley

Casa de Chocolates in Berkeley

El Cerrito Natural Grocery in El Cerrito and Berkeley

Batch Pastries in Oakland

Wooden Table Baking Co. in Oakland

Souley Vegan in Oakland

Franklin Brothers Market in Berkeley

Rotha in Albany

La Note in Berkeley

The Xocolate Bar in Berkeley

Inn Kensington in Kensington

Saul's Restaurant & Delicatessen in Berkeley

Boichik in Berkeley

Anaviv in Richmond

La Strada Cucina Italiana in San Pablo

Arizmendi Bakery in Oakland, Berkeley, Emeryville, San Rafael and San Francisco

For Those Needing to Unwind

Stress abounds in these uncertain times. Consider a few relaxation "techniques":

Cask in Berkeley and San Francisco

Ordinaire Wines in Oakland

Nickel Dime Cocktail Syrups in Oakland

Absinthia in Oakland

Sons of Liberty Alehouse in San Leandro

Drake's Brewing Co. in San Leandro and Oakland

Fieldwork Brewing in Berkeley

Naveana Nail Salon in Albany

Piedmont Springs in Oakland

Coffee & Tea Lovers

Stay warm during those cold mornings:

Catahoula Coffee in Richmond and Berkeley

Timeless Coffee in Oakland and Berkeley

Highwire Coffee in Albany, Berkeley, Alameda and Oakland

Farley's Coffee in Oakland and San Francisco

Artis in Berkeley

Bookworms & Audiophiles

Books and music are some of the best ways to buy local:

Pegasus Books in Berkeley and Oakland

Builders Booksource in Berkeley

East Bay Booksellers in Oakland

Moe's Books in Berkeley

Spectator Books in Oakland

Walden Pond Books in Oakland

Dave's Record Shop in Berkeley

Stranded in Oakland

Green Thumbs

For your gardening-loving and eco-conscience friends:

Flowerland in Albany

Momo's Flowers and More in Albany

Orchid Florist in Berkeley

Berkeley Horticultural Nursery in Berkeley

Blk Girls Green House in Oakland

Crimson Horticulture in Oakland

Mudlab in Oakland

Fillgood in Berkeley

Arjan Flowers & Herbs in Oakland

Gift Stores

Having a difficult time thinking of what to get for the hard-to-gift someone? Consider a few special stores:

Greetings in Berkeley and Oakland

Jenny K in El Cerrito

Fern's Garden in Berkeley

Ceci Bowman in Berkeley

Umami Interiors in Albany

MorningTide in Albany

Tail of the Yak in Berkeley

The Gardener in Berkeley

Narrative in Oakland

Nathan & Co. in Oakland

Bay-Made in Oakland

Gathering Tribes in Richmond

Urban Indigo in Oakland

Mom & Pop Art Shop in Richmond

Richmond Art Center in Richmond

Bart Bridge in Oakland

Maison d'Etre in Oakland

Halmar in Berkeley

Lava 9 in Berkeley

Yaza in Berkeley

Siamese Dream in Berkeley

510 Skate Shop in Berkeley

Creep Mustache Skate Shop in Oakland

Games of Berkeley in Berkeley

Luvhaus in Oakland

Daisy's in Alameda

This hardly scrapes the surface of what the East Bay has to offer, but it should serve as a helpful resource for your last minute shopping needs. Let's do what we can to support our local business and ensure that we uphold the beautiful diversity of our community.

RECENT TRANSACTIONS

MARKET UPDATE: NOVEMBER 2020

This year, the East Bay real estate market has been anything but usual. Hard to believe that only 8 months ago we didn't know if there would even be a market at all!

For the first few months after shelter-in-place went into effect, the market struggled to get back to normal. Now it is thriving. In November, the number of sales jumped 40% over last year, the highest November we've seen since 2005. Median price grew 18% to $1,100,000, close to an all-time high (which was $1,120,500 in July). In addition, homes sold further over asking at an average of 12% over list, and at the fastest speed ever recorded: an average of just 16 days on market.

Looking forward through December, expect the market to be more active than previous years. For example, we usually expect new listing activity at this time of year to be about 1 per week; on the week of 11/30, 154 listings came to market. In addition, pending inventory is 50% higher than last year. This also suggests that January will be unusually active, maintaining a high level of competition among East Bay buyers.

Drop a line if you'd like to know how these trends affect your real estate goals.

MARKET UPDATE

Interest rates have maintained record low levels throughout 2020 but many bond market watchers are fearing that the party may be coming to an end. Risks are beginning to mount for the rate outlook - at least in the sense of mortgage rates being relatively impervious to broader bond market weakness. In other words, if Treasury yields fall, mortgage rates can easily continue to lower. However, if yields continue to rise, mortgage rates will be finding it harder and harder to resist the urge to follow. At the time of this report, the fiscal stimulus is the biggest near-term risk. If there is no agreement on stimulus before the 12/16/20 Fed announcement, the Fed will be more likely to extend the maturity of its bond portfolio (buying longer-dated bonds but not increasing the number of purchases). This would be good for rates. The opposite scenario (fiscal stimulus and no Fed maturity extension) would be bad. On the more distant horizon, a surprise democratic sweep in Georgia (senate), or an unexpected shift toward stronger economic data are risks for rates as well. They may or may not be offset by a wintertime surge in COVID case counts and lockdowns. Either way, traders seem to be planning on a COVID-free economy by this time next year, leading to higher rates.

If you are interested in refinancing or getting preapproved for a mortgage, now is the time. Please contact Faramarz Moeen-Ziai at CrossCountry Mortgage via fmz@myccmortgage.com or 510.254.4697.

Personal NMLS284360 | Branch NMLS2020284 | Company NMLS3029

NOVEMBER 2020

November 2020

Hello everyone:

I truly hope all is well. 2020 is a test for sure - testing our will and our mental stamina. What I do think it has done, for me personally, is bring into greater focus family and the bond we have. There have been so many moments when we have been able to tighten that connection, carve out a hearty laugh, and find ways to temporarily unwind. This is the sweet light, this is the affirmation for me. And I am grateful. Above are pictures of my 77-year-old mom playing hopscotch with her 5-year-old grandson and a quick group shot with the queen of furry love - Lola - 17 years (!) and still with us. And we are forced to hunker down once more and plow through, I hope you too have been blessed, not necessarily by the weeks but by the very human moments that we can all share and get needed nourishment from.

Scott

MOVING OUT? SHOULD YOU RENT OR SELL?

Many Bay Area residents have considered moving away due to the pandemic, fires and smoke, and the freedom of distance learning and working remotely. If you are one of these people and you are trying to decide if you should sell or rent your home, here are a few questions you may want to ask yourself when making this important decision.

Do you plan on moving back to the Bay Area? If you plan on permanently moving out of the East Bay, then selling may be a good way to go, especially if you plan to purchase a home elsewhere. However, if you will be coming back to the Bay Area after a few years, it might be best to rent your property because the barrier to re-entry in the East Bay will likely become more difficult with rising median sales prices and increased buyer demand. Just remember to keep local rental control laws in mind.

Do you need the equity of your current home to purchase a new home? The Bay Area has consistently remained one of the strongest real estate markets in the country, so maintaining an investment here is a good idea. However, if you want to buy your home in your new city and need to leverage the equity in your current home, selling is the way to go.

Are you prepared to be a landlord or hire a property manager? If you are thinking of renting your property, remember that no one will treat your home the way you do. Be prepared to answer plenty of maintenance calls as well as account for additional expenses. Consider factoring in the cost of hiring a property manager; it will cost more, but it will alleviate some of the overall stress of renting your property.

Have you been keeping up with your home's maintenance? Is your home seismically retrofitted? Do you have a high threat of flooding or fire? If you can do the necessary work to protect your home, do it. If not, assess the financial risk you might face if any disaster were to occur.

What is your timeline? If you plan to rent your property, keep in mind you will lose the capital gains exclusion that applies to homeowner-occupied properties if you don't live in your home 2 of the last 5 years (an exemption of $250,000 for single persons or up to $500,000 for married couples). Otherwise, your home will be taxed as an investment. In order to get a tax break, you'll need to be able to show the depreciation of the asset by finding your net income and depreciation per year. This is a great way to keep equity growth in your home especially if income remains above expenses. Speak to your CPA for more details.

Consider legal requirements and financial incentives. Selling your home does not constitute a good enough reason to ask tenants to move out, so paying tenants to relocate is a potentially expensive option. If you identify your property as a 1031 Exchange, you may be able to do a tax-deferred exchange which allows you to purchase a replacement property of equal or greater value nearly anywhere in the United States. Furthermore, investments in Opportunity Zones, which are communities identified as "economically distressed", could receive preferential tax treatment.

Also, remember that Red Oak is a member of the Leading Real Estate Companies of the World which means wherever you want to start your next chapter we can help refer you to a qualified agent anywhere in the world. Reach out if you'd like data or assistance in making your move.

RECENT TRANSACTIONS

MARKET UPDATE: OCTOBER 2020

Oh how far the East Bay market has come. Back in March, Shelter in Place saw activity drop over 30% in a few weeks. It's been in recovery mode since early April. Now that we've reached October, the market is looking better than it has in years.

In October, the number of transactions increased 15% compared to last year, the highest it's been since mid-2018. Median price also increased 16% to a median of $1,050,000, an all-time high for the region. Properties sold an average of 11.4% over list price, a big uptick from 2.5% one year ago, and homes were on the market for an average of just 19 days.

Since the election, new listing activity seems to have slowed. This makes sense for a variety of reasons, including the fact that we're getting close to Thanksgiving. However, as of 11/9, we still have 8% more listings available for sale than we did last year and the number of homes under contract is 57% higher than last year. This leads us to believe that activity will be higher in November and December than previous years.

Reach out to see how these trends affect your real estate goals.

MORTGAGE UPDATE

Both frontrunner COVID-19 vaccine trials have announced surprisingly strong late-stage results (Pfizer on 11/9 and Moderna on 11/16) and while it's still early to know how long-term efficacy and safety will pan out, if anything is capable of instilling optimism in financial markets (and the global community in general), this is it. But the tangible justification for that optimism also comes with a fairly lengthy waiting period. And between now and then, we have the world's most severe spike in COVID case counts to deal with heading into the winter months. Bonds spiked on the news on both days but retreated back by the end of the week, keeping rates at record low levels. The two biggest question marks when it came to whether rates would stay low over the past six months have been the election and a vaccine announcement. With both events hitting back-to-back and having a negligible impact on rates, it looks like the low rate environment is here to stay for at least the next six months.

If you have any questions about this or would like to inquire about getting preapproved for a mortgage or refinancing an existing mortgage, please contact Faramarz Moeen-Ziai at CrossCountry Mortgage via fmz@myccmortgage.com or 510.254.4697.

Personal NMLS284360 | Branch NMLS2020284 | Company NMLS3029

EQUITY BOOK CLUB: NOVEMBER RECOMMENDATIONS

The Red Oak community has been busy raising awareness of the history of segregation and redlining in the Bay Area and the US, and the role real estate agents have played throughout history. This month we are recommending Race for Profit by Keeanga-Yamahtta Taylor and Caste: The Origins of Our Discontents by Isabel Wilkerson. Race for Profit discusses how racist housing practices continued well after the ban on housing discrimination, resulting in a devastating impact on the African-American community. Caste has been described by Dwight Garner of The New York Times as "an instant American classic and almost certainly the keynote nonfiction book of the American century thus far." Cozy up and enjoy these informative pieces of literature.

LOCAL BUSINESS SPOTLIGHT: LUVHAUS

This month's local business spotlight is Luvhaus. Based in West Oakland, Luvhaus creates earthenware ceramics by a team of skilled artisans. Their goal is to make something that's both functional and rejuvenating under their philosophy, "...a cup is a symbol. Of gatherings, of rest and reflection, sharing and community, conversations and love. Our goal is to create something that will stand the test of time." They create everyday items such as bowls, pitchers, plates, and mugs.

These next few months are critical for keeping local businesses alive so be sure to shop local!

info@luvhaus.com | @luvhaus | 1793 12th Street, Oakland